Where is the biggest risk in the market today? Is the volatility of all assets falling? Is the civil strife in Iraq detonating the Middle East crisis? Michael Hartnett, chief strategist at Bank of America Merrill Lynch Global Equity, believes that the biggest risk on Wall Street is that Wall Street is forcing the Fed to step up its efforts to tighten the currency.

Hartnett expects US stocks to rise this summer and fall sharply in the fall, with the S&P 500 likely to fall more than 10%.

He said that the longer the economic growth and benchmark interest rates return to normal, the greater the risk of speculation, and ultimately the higher the policy risk before the full recovery of the economy to curb speculation in this asset market.

Hartnett is worried that this kind of "warm" economic recovery is just happening when US stocks are rising and global investors are optimistic. Such an environment will have two very different results, which may cause the Fed to act:

“The 'ice' of technological innovations that are de-leveraging, regulatory and declining is still extinguishing the 'fire' of zero interest rates and central bank liquidity. At the same time, Wall Street is still thriving.

"In this world, the financial resources of Wall Street and capital are rolling, and mass retailers and laborers are struggling."

Because of the unusually harsh winter weather, the US GDP revision rate fell to -1% in the first quarter of this year, the first decline since the first quarter of 2011. Many experts expect a rebound in the second quarter.

Hartner sees third-quarter GDP as an important indicator of future trends, as it may be the key to predicting the true state of the economy.

Hartner believes that if the GDP growth in the third quarter exceeds 3%, it proves that the economy will recover steadily and interest rates will rise. Otherwise, the speculative asset boom will lead the Fed to use words to suppress asset prices.

He also mentioned that the credit market provides a leading indicator of this false prosperity. One such indicator of the 1987 crash was the gradual increase in government bond yields and gold prices, while corporate bond prices fell.

Complete with domestic and imported from Germany interlining production line,we have the specialized strong technical force,advanced detection system to guarantee the stability of the production quality.

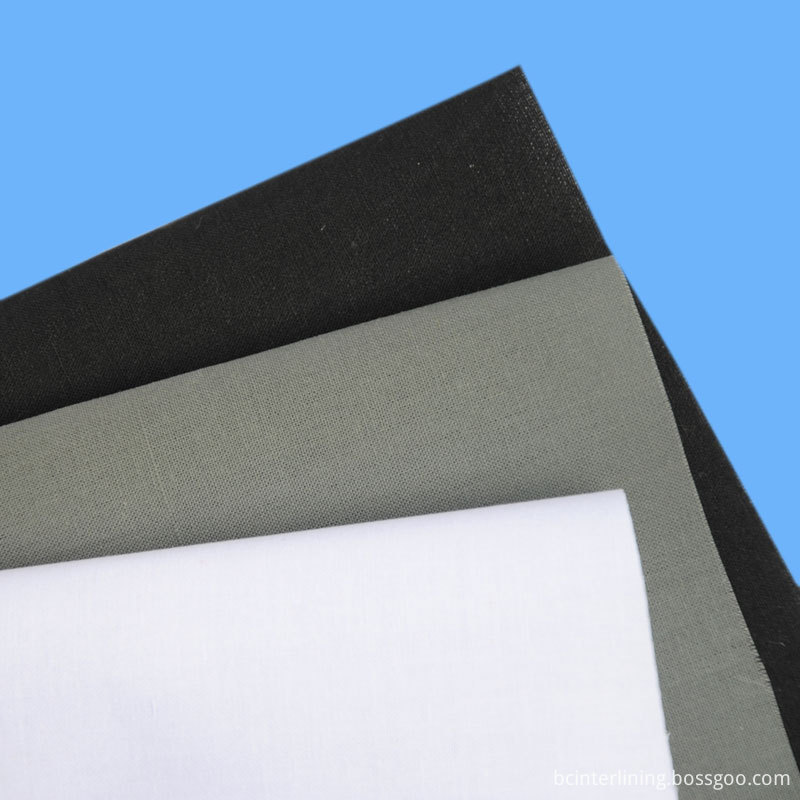

All kinds of Bag Interlining .

Composition 100% polyester and 80% polyester +20% cotton .Color can do white ,offwhite ,black ,charcoal and so on .Touch can do soft ,medium ,and hard .

Composition 100% polyester and 80% polyester +20% cotton .Color can do white ,offwhite ,black ,charcoal and so on .Touch can do soft ,medium ,and hard .

Bag Interlining

Bag Interlining,White Color Bag Interlining,Resin Interlining For Bag,Non Fusible Interlining For Bag

Baoding Garment Interlining Factory , https://www.bcinterlining.com